The FIRE Movement: A Minimalist Guide to Financial Independence, Retire Early

Master the 4% rule to calculate your exact FIRE number, slash expenses through intentional minimalism, and reclaim decades of freedom from the 9-5 grind.

The key objectives of The Rich Minimalist mini-manifesto are health and freedom. In modern life’s trap we are very unfree. We are especially financially unfree. Being financially free is the basis for freedom. The FIRE principles can provide a solution.

Introduction: The Race to Financial Freedom

The FIRE Movement—Financial Independence, Retire Early—is more than a financial strategy. It is a cultural phenomenon that challenges the traditional 40-year career path—an idea that I like very much at The Rich Minimalist (challenging rules just because of tradition).

At its core, FIRE is about optimizing your life to achieve Financial Independence as quickly as possible, giving you the option to Retire Early and pursue a time-rich life.

In this post I will demystify the FIRE movement, break down the core mathematical principles, explore the different strategies that have emerged, and provide you with actionable steps to accelerate your journey to financial freedom.

The Core Math of FIRE: The 25x Rule and the 4% Safe Withdrawal Rate

The entire FIRE movement is built upon two foundational mathematical concepts that determine your “FIRE Number”—the amount of money you need invested to stop working.

1. The 4% Safe Withdrawal Rate (SWR)

The 4% SWR is derived from the Trinity Study, which analyzed historical market data to determine a safe percentage of a portfolio that could be withdrawn annually without running out of money over a 30-year retirement period.

2. The 25x Rule

The 25x Rule is the direct application of the 4% SWR. To find your FIRE Number, you simply multiply your desired annual expenses by 25.

For example, if your intentional, minimalist annual expenses are €40,000, your FIRE Number is €1,000,000. Once your investment portfolio reaches this amount, you are considered financially independent.

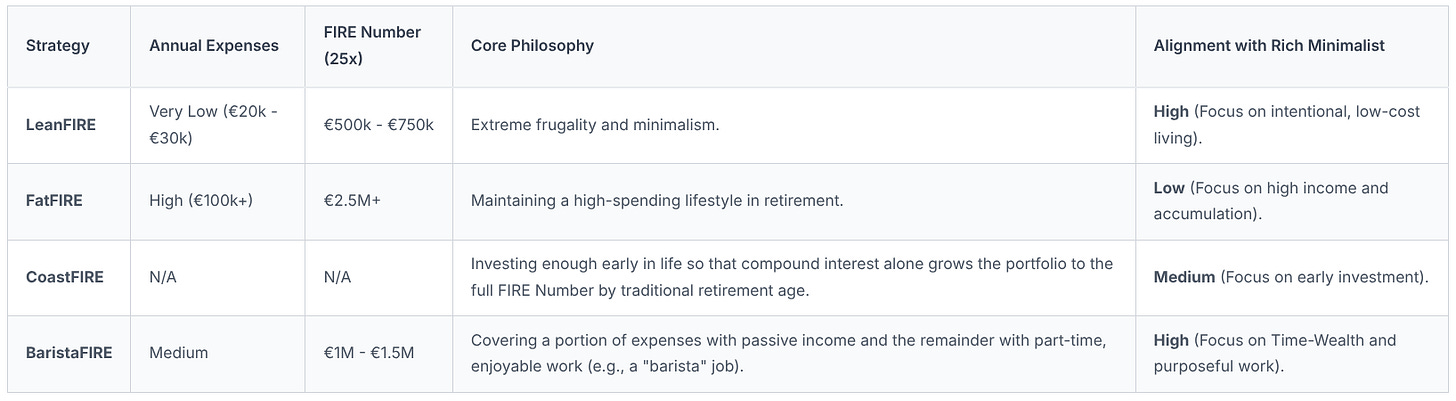

The Spectrum of FIRE: Finding Your Strategy

The movement has evolved beyond a single, rigid path. Your personal philosophy, risk tolerance, and desired lifestyle determine which FIRE strategy is right for you.

So, FIRE is a spectrum and it depends on your preferences where on that spectrum you feel comfortable. The Rich Minimalist philosophy aligns most closely with LeanFIRE and BaristaFIRE, emphasizing that a lower expense base is the fastest and most reliable path to freedom.

I personally follow the BaristaFIRE strategy. Yes, I want to live minimalistically—focus on what’s really important for me—but I also want to enjoy life. I know what’s the lifestyle that I like and expect from my life. I know what this cost. So, now I can work towards achieving that number via a mix of passive income streams and active incomes from projects that I am really passionate about.

The Three Pillars of FIRE Success

Regardless of the strategy you choose, the path to Financial Independence is built on three core pillars:

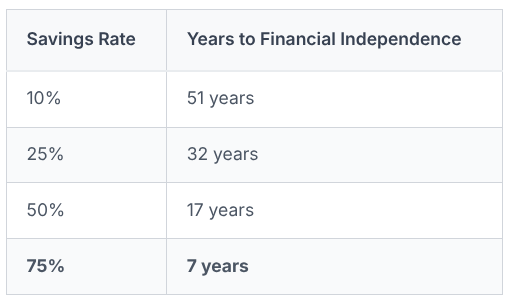

Pillar 1: Maximize Your Savings Rate

The single most important factor in achieving FIRE is your Savings Rate—the percentage of your net income (=after-tax income minus expenses) that you save and invest. A high savings rate dramatically reduces the time it takes to reach your FIRE Number.

The table below is indicative. The exact numbers depend on your context, the inflation rate and the annual return-on-investment of your investments.

Pillar 2: Intentional Frugality and Expense Reduction

This is where the Rich Minimalist philosophy provides its greatest leverage. Every dollar you cut from your annual expenses is a double win:

It increases your savings rate (Pillar 1).

It lowers your FIRE Number (The 25x Rule).

This intentional reduction of expenses is not about suffering; it is about eliminating the “financial clutter” that does not contribute to your happiness or Time-Wealth.

Pillar 3: Consistent, Aggressive Investing

Your savings must be put to work to generate Passive Income. The FIRE movement typically advocates for:

Low-Cost Index Funds: Investing in broad market index funds (like those tracking the S&P 500 or a global index) minimizes fees and maximizes long-term returns.

Automation: Set up automatic transfers to your investment accounts to ensure consistency and remove emotion from the process.

Debt as Investment: Pay off high-interest debt (like credit cards) first, as the guaranteed return is higher than almost any market investment.

A tactic that I personally use is that whenever I have cash, the first thing I do is invest it somewhere—put the money to work. That forces me to be disciplined. There is no other way.

I also love automations. I am an automations nerd. Everything that’s a proven process can be automated. It’s done automatically and reliably, and it’s out of my mind. More time, more freedom.

Investing is a HUGE topic and ideally you spread the risk by investing into many different investment types. Basically by creating a diverse portfolio. I will cover this in another, dedicated post.

FIRE in 2025: Adapting to a New Economic Reality

The FIRE movement remains highly relevant, but the strategy must adapt to modern economic challenges:

Inflation and Market Volatility: The 4% SWR is a historical average. Modern practitioners should consider a more conservative 3.5% SWR or build in a “buffer” year of cash.

Health and Longevity: Early retirement means a longer retirement. Planning for healthcare costs and maintaining an active, purposeful life (the Time-Wealth component) is critical. That is exactly why one of the two key components of The Rich Minimalist philosophy is health.

The Rise of AI and Side Hustles: The pursuit of Passive Income is easier than ever through digital assets, online businesses, and AI-driven side hustles. These can significantly accelerate the journey by boosting income without requiring a traditional second job.

This is GREAT news. AI is super powerful—but it has to be used with care. At the end, it always does not the human (quality) control. But it is clear: the window of opportunity with AI is NOW.

Actionable Steps to Start Your FIRE Journey

The first step is always to gain clarity on your current financial position and your goal. You cannot manage what you don’t know.

Audit Your Expenses: Get an overview over all your expenses per month: rent, bills, loans, mortgage, shopping, subscriptions, transport, eating out, etc. Analyse your credit card and bank account statements. Identify the top three areas where you can apply intentional living to reduce spending without sacrificing happiness.

Calculate Your Current Savings Rate: Be honest about the percentage of your income you can invest.

Determine Your FIRE Number: Use the 25x Rule based on your intentional annual expenses.

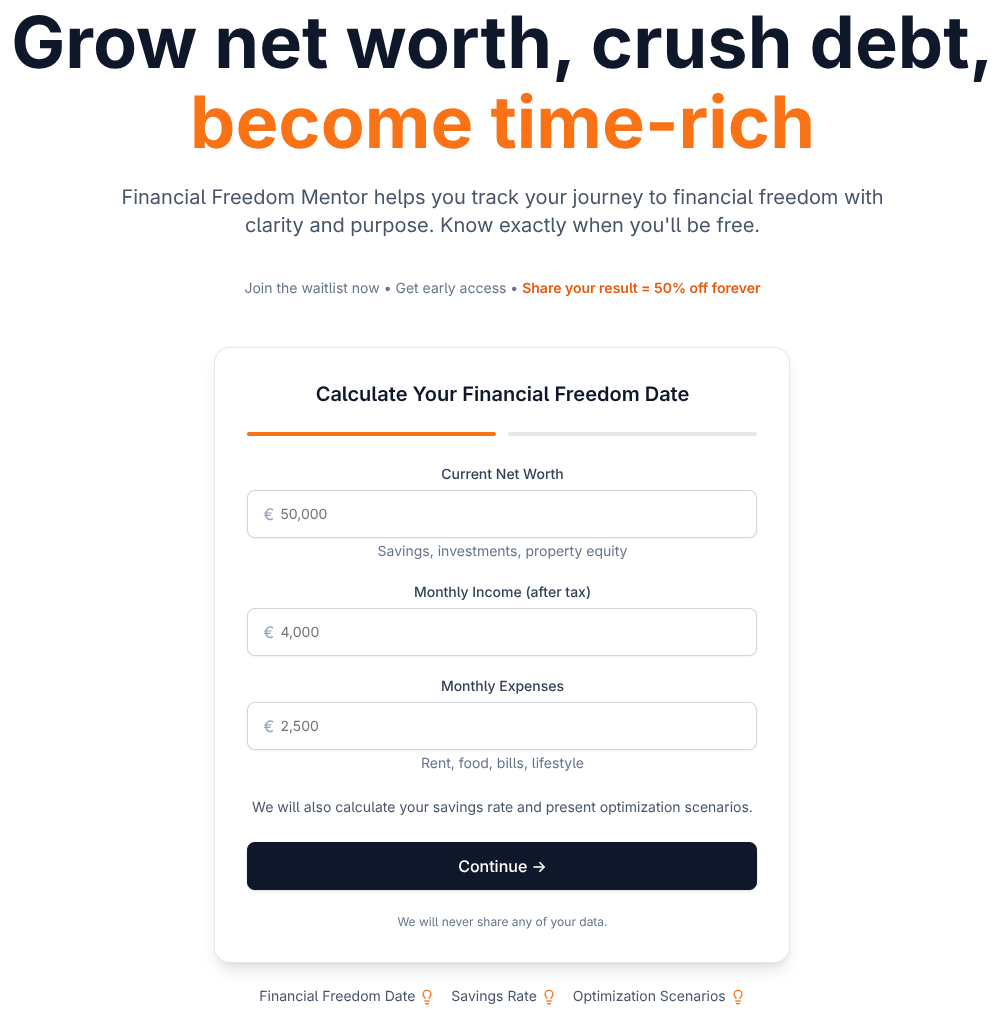

Find Your Freedom Date: Use a calculator to project the exact date you will achieve Financial Independence. Also check at the end of this post.

Track Your FIRE Journey to be Free and Time-Rich

I developed an app for myself to calculate, monitor and manage the key metrics on my journey to financial freedom. I found it super useful. It increased transparency, and improved my decision making and disciplined.

I decided to improve this app and publish it for general use: The Financial Freedom Mentor app. It will be available starting February 2026. It’s the essential tool built to guide you through the complexities of the FIRE movement. It integrates the core principles of the Rich Minimalist philosophy with the practical math of FIRE.

It helps you:

Track your Savings Rate and Passive Income growth in real-time.

Visualize your FIRE Number and the progress toward it.

Reduce debt.

Get your questions answered by a Money Mentor.

Build your financial knowledge via money micro lessons.

In the meantime, you can already start calculating your financial freedom date.

I created a Freedom Date Calculator to help you find your FIRE Number. It’s entirely free. Click the button below to access it: